What happens off-exchange stays off-exchange.

But if you've heard someone use that Vegas line to describe their Vegas time, you know there is more to the story.

And so it is with equity trading. Whether you are the venue analyzing competitive intelligence, the sell-side optimizing trade strategies, the market-maker analyzing routing, or the buy-side seeking liquidity, knowing what happens off-exchange matters.

Like knowing you might wake up between Mike Tyson and a tiger in a Vegas hotel.

Off-exchange activity starts with Alternative Trading Systems (ATSs). In recent years new startups have entered the market (OneChronos, Purestream, and Blue Ocean). ATSs have merged (Luminex and LeveL). Big banks have launched ATSs (Citi-ONE). And brokers have consolidated ATS platforms (Weeden, Piper Jaffrey, and Sandler O'Neil into the concise, stealth ATS name “XE”).

You might wonder what allures startups, banks, and brokers to enter this incredibly competitive market to play a zero-sum game where the price of entry is SEC and FINRA regulation and compliance. Like high rollers to the lights of Vegas, venues of all shapes and sizes are attracted to the thirty to forty percent of U.S. equity volumes that trade off-exchange. We love analyzing the space because its intense competition and ever-changing market dynamics can spur trading innovation.

When one ATS wins market share another ATS loses market share. That’s if they’re lucky. It is more cut-throat than that because ATS off-exchange market share itself is not static. ATSs compete with over a hundred brokers with off-exchange single-dealer platforms (SDPs) and internal crossing networks. Some of them are large: Citadel, Jane Street, Robinhood. Some have both ATSs and SDPs: Goldman Sachs, Morgan Stanley. And together, the ATSs and brokers compete with a growing number of listed market exchanges almost wholly incentivized to reduce the amount of volume trading off-exchange.

The off-exchange game has a simple objective and complex methods. The objective is to match buyers and sellers. The methods include negotiating market price, volume, volatility, and market-impact. Integrating with other market participants and trading systems, often ‘frienemies’, adds more complexity. All of which must be navigated to optimize a matching objective measured in time slices of milliseconds1.

Want to launch an ATS?

We don’t. Though a few of our Focus Signal subscribers did, so rest assured you are in mad company here.

Venue shape.

Point Focal’s off-exchange liquidity module helps market participants understand the space. And our new analytics helps one see the space differently.

A venue’s value is measured by how efficiently it connects participants. And this can be observed through volume and average trade size rankings, both proxies for market share. Depending on the design of a venue's matching logic, venues may rank higher on total volume or average trade size. Or their rankings may be a blended balance between the measures.

We're showing the shape of the venue landscape across these rankings. And we are shaping portfolios within these rankings. Shapes change across ATS and broker venues, and across market cap and sector. They morph further across price, volume, and volatility characteristics.

This is what it means to see a portfolio differently. Let's look at some shapes.

The following is a series of off-exchange venue and portfolio shapes. A new analytic lens. And for a certain kind of market practitioner, information value.

First a note on interpretation:

Scatterplots

X & Y axes are average trade-size rank and total volume rank respectively

Both axes are inverted (wait, what?)

Up (volume) and to the right (trade-size) are highest ranks

Markers are symbols, colored by market-cap, and sized by number of trades

Except the last chart in each series where markers are venues

Markers are sized by trade count

Vertical and horizontal lines are drawn at top-10 rank cutoffs

Markers above and right of the lines are top-10 in volume and trade-size

Vertical Bar Charts

X-axis: volume and trade-size rank position

Y-axis: symbol count in selected portfolio or index

The Startups

OneChronos and Purestream recent activity in the KRE Regional Banking ETF2.

OneChronos matches orders using periodic auctions with randomized start times. The auctions use mathematical optimization to seek optimal matches across all orders. Expressive bidding allows users to input specific execution instructions at the matching engine level precisely tailored to execution or investment strategy objectives3.

PureStream order types enable differentiation by separating the price and liquidity discovery process. Percentage rate based order types are used to match orders. The matched orders percentage rate is applied to each of the stocks subsequent trades reported to the “tape” to create a stream of trades4.

OneChronos and Purestream average volume and trade-size ranks across all ATS venues in recent KRE activity.

Both startup platforms are using unique, innovative matching strategies to capture market share. Going from zero volume to meaningful volume is a hard thing to do. This achievement alone means they are worthy of attention. Transforming standard off-exchange data structures to capture venue-specific strategies may improve our analytic lens. We consider this opportunity for further exploration.

Two ATSs. One company.

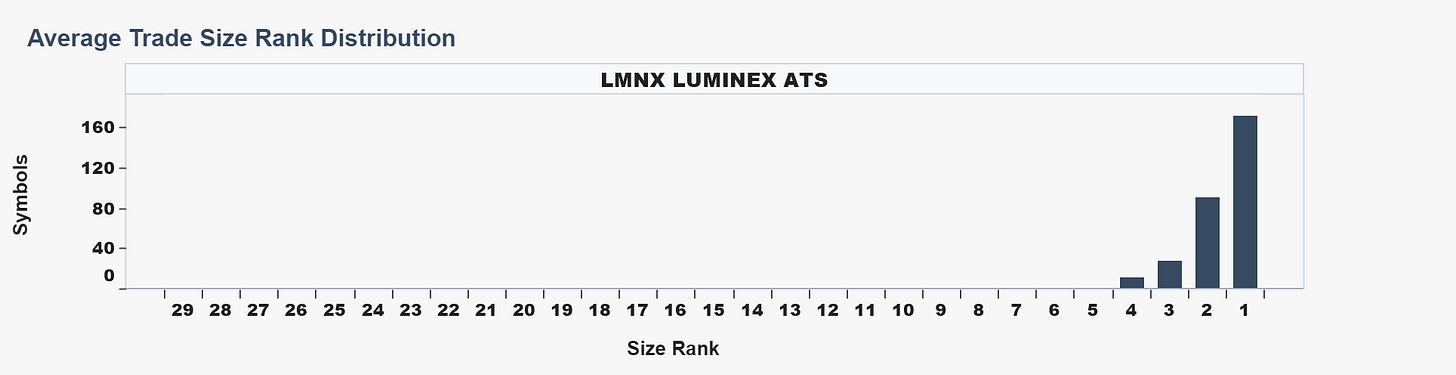

LeveL ATS and Luminex recent activity in the S&P 500.

LeveL ATS is a continuous crossing US Equity Alternative Trading System (ATS), designed to transform dark pool executions with crossing innovation5.

Luminex is a completely anonymous, non-quoted trading venue that satisfies the liquidity needs of buy-side firms and prevents the main challenges of dark pools, such as intermediation, fragmentation, fall downs, information leakage, and concerns around ownership and control of trade data6.

LeveL and Luminex average volume and trade-size ranks across all ATS venues in recent S&P 500 activity.

The answer to why these platforms merged is explained by their shapes. Look again and note how their distribution shapes are mirror images of each other. In fact, if we were to fold the venues chart in half on its straight-line fit7, LeveL and Luminex might actually touch each other. Their shapes are complementary liquidity profiles. They each have what the other lacks. Symbiotic venues.

An Adverse Selection Protection Engine and the 3rd largest U.S. bank.

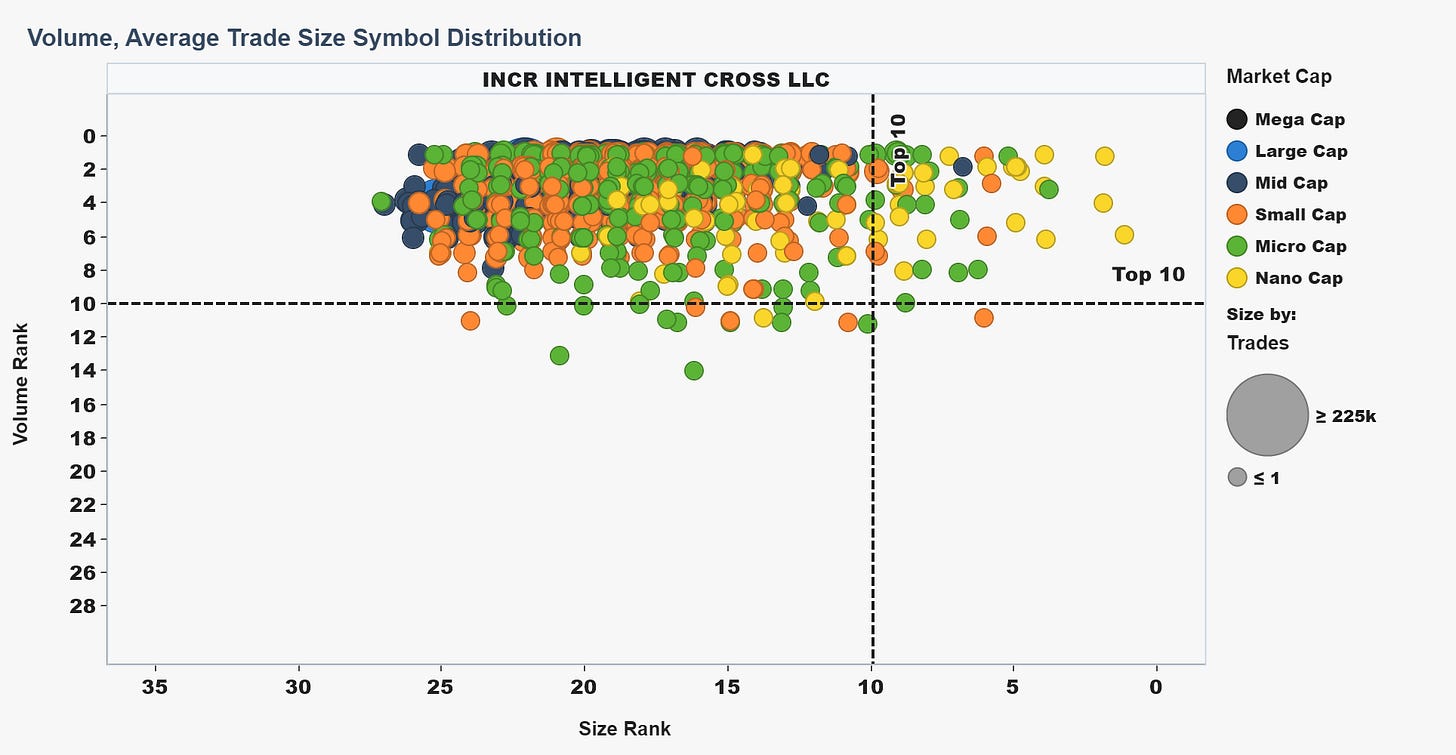

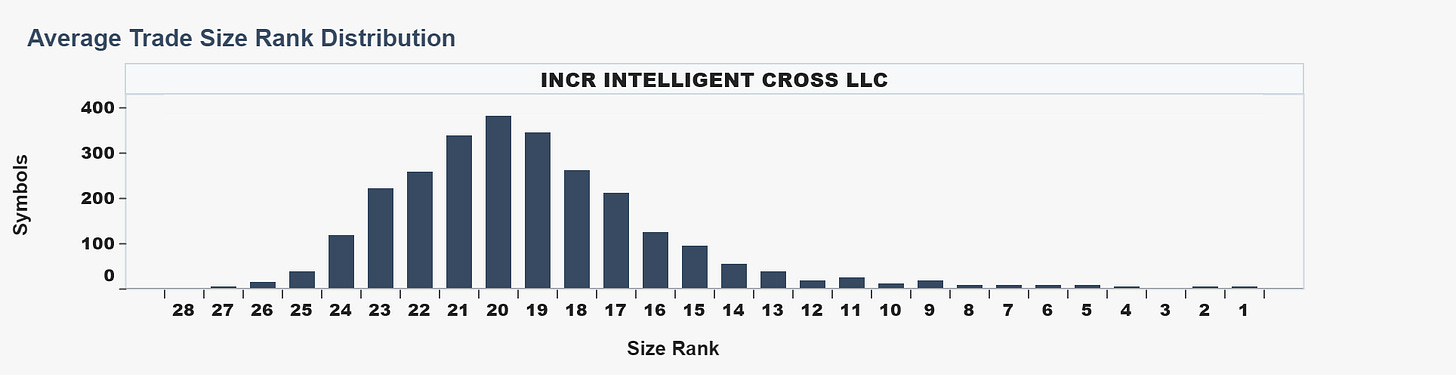

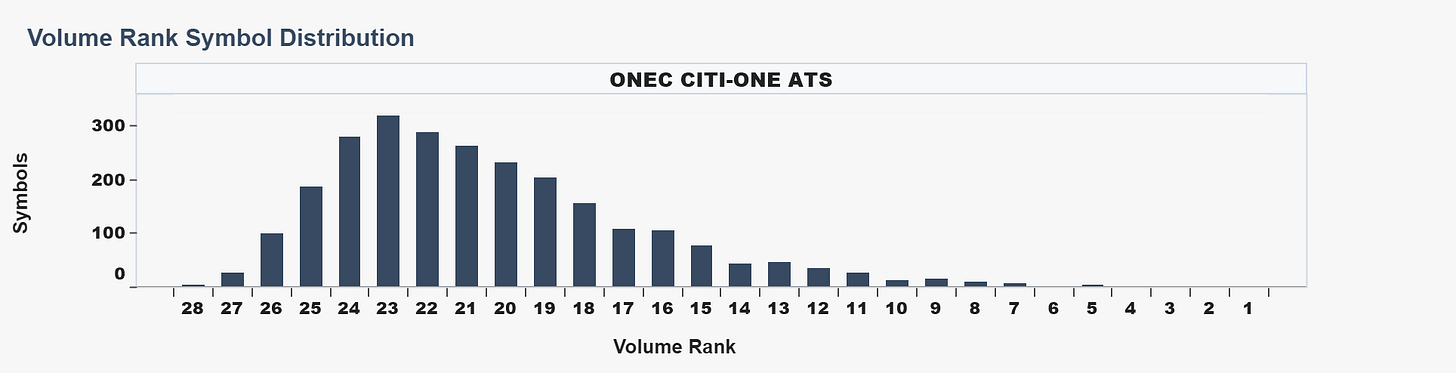

IntelligentCross and Citi-ONE recent activity in the Russell 3,000.

IntelligentCross is an ATS that uses AI to optimize price discovery. It matches orders near-continuously, within microseconds of arrival, to achieve maximum price stability after trades8.

Citi-ONE is a Citigroup Global Markets, Inc. (“CGMI”) ATS launched in 2022.

IntelligentCross and Citi-ONE average volume and trade-size ranks across all ATS venues in recent Russell 3,000 activity.

Citi has been through the ATS life-cycle before, from launch to exit. Their return suggests they have lessons learned and new strategic purpose. IntelligentCross is backed by Point 72 Ventures. Their Russell 3,000 shape, like balloons to a ceiling, reflects their continued growth.

Top non-ATS broker average volume and trade-size ranks in recent S&P 500 activity.

While this post is focused on the ATS segment of off-exchange activity, we can also see Citadel, Virtu, Jane Street, and Robinhood among a different venue segment, with different shapes.

What happens off-exchange can be observed. The players allocating resources to off-exchange activity is signal that there is signal off-exchange.

When market activity goes from opaque to transparent, information value and opportunity arise.

Viva las venues.

One one-thousandths of a second. Or about 0.004% of a human eye-blink.

KRE: SPDR S&P Regional Banking ETF (exchange traded fund).

Line of best fit refers to a line through a scatter plot of data points that best expresses the relationship between those points. - Investopedia